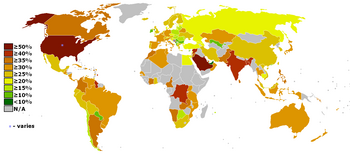

English: Tax rates around the world: Corporate tax rates (the highest rate) by countries Polski: Stawki podatkowe na ?wiecie: CIT (najwy?sza stawka) w poszczególnych pa?stwach (Photo credit: Wikipedia)

{Published in the Colorado Springs Gazette, May 23, 2013}

Oh no! A highly successful American corporation has successfully avoided billions in taxes! I’m shocked, shocked to find that tax avoidance is going on in America. Congress should call a hearing immediately! Oh, wait, they already have.

This week, the Senate heard testimony from Apple about its corporate tax payments. According to Congressional critics, Apple has used “gimmicks” and “schemes” to shelter its foreign earnings from taxation. Curiously, no one seems interested in pointing out that these gimmicks and schemes were all enthusiastically approved through years of Democratic and Republican administrations, by the same Congress that now claims outrage.

The real tragedy behind this farce is not that Apple is avoiding taxes, but that it operates in an environment where it makes complete sense for them to build such an elaborate legal house of cards. Apple should be investing its time and human capital into designing the next iWhatever. Instead, it must waste time and money to construct legal fictions, just so it can keep more of what it earns. Why does it do this? Because of America’s predatory corporate tax rates.

The United States, for all its claims of capitalist glory, taxes corporate profits at a maximum of 35 percent, the highest in the world. (The effective tax rate is lower, but that’s precisely because of all the “gimmicks” and “schemes” needed to avoid paying such a ridiculous figure). But if that’s not enough, foreign earnings (over 60 percent of Apple’s revenue) are taxed in foreign jurisdictions first. So it’s actually double taxation. But we’re still not through.

When corporate profits are paid out to shareholders as dividends, they can be taxed again. For those of you who are counting, that’s triple taxation. But that’s triple taxation on greedy capitalist multinational corporations, which is by definition fair, so it’s OK. Or so the thinking goes.

We already know how the farce will end. People are going to call for “reform”, the siren song of every political cause since time immemorial. But we’ve been reforming the corporate tax system for the past 50 years. All that has got us is the most complicated corporate tax system in the world.

In fact, we shouldn’t hate the player. We should hate the game, and we ought to change it. We can do that in two ways: Adopting a territorial corporate tax system, and lowering corporate tax rates.

With a territorial system, profits earned overseas are only taxed in the jurisdictions where they are earned, and not in the United States. This is what most of our trading partners do. Not only would it remove the double taxation on foreign earnings, but it introduces healthy tax competition among countries. If we’re worried that it would encourage multinationals to move operations overseas, then we should lower our corporate tax rates to keep the jobs here.

How much lower? I vote we should at least match our neighbor to the north and drop our maximum corporate rate to 15 percent. Yes, that’s right. Canada, the Great White North of rampant capitalism, taxes corporate profits at rates less than half of the U.S. What can I say? I guess all their voters are corporate flunkies.

Or maybe they’re onto something. Before you panic about where the lost revenue will be made up, look at the data. The best evidence we have shows that, as a percentage of GDP, Canada raises 95 percent of America’s revenue with a tax rate of less than half. And why shouldn’t they? Businesses like to locate there, since they don’t have to build legal fictions to keep more of their profits. Unlike in the U.S.

Ultimately, only entrepreneurs in the private sector, as epitomized by Steve Jobs and Apple, can create wealth and make the economy grow. For that, they should be applauded. But in our upside-down world where wealth redistribution is exalted and wealth creation is punished, they are called before Congress for trying to keep more of what they earn. It’s a farce. It’s just not particularly funny.